Buying a car has always been a stressful endeavor. People all over the world have been carefully saving their funds, planning their finances and negotiating to get themselves a new set of wheels since before the first Model-T’s even started rolling off Henry Ford’s assembly lines back in 1908. Today, deals on extra carriage wheels and free horse blinders have been traded in for limited maintenance agreements, loans, and down payment plans, but the necessity of owning your own vehicle has only become stronger. Throw in a couple years of pandemic supply chain issues and parts scarcity to drive supply down and demand up, and you’ve got one of the most difficult markets auto buyers have faced in decades.

Though everyone today is grappling with the effects of the pandemic, and almost no one is completely insulated from the unexpected costs it keeps surprising us with, nobody in the market for a new vehicle has it worse than those who have been marked by society with bad or low credit. The stigma attached to such designations often takes the car buying experience from being a difficult and costly one to a downright impossible task. A bad credit score can leave people trying to navigate markets filled with ever soaring prices without any ability to even find a lender for support, much less find a loan that won’t break the bank with sky high interest rates.

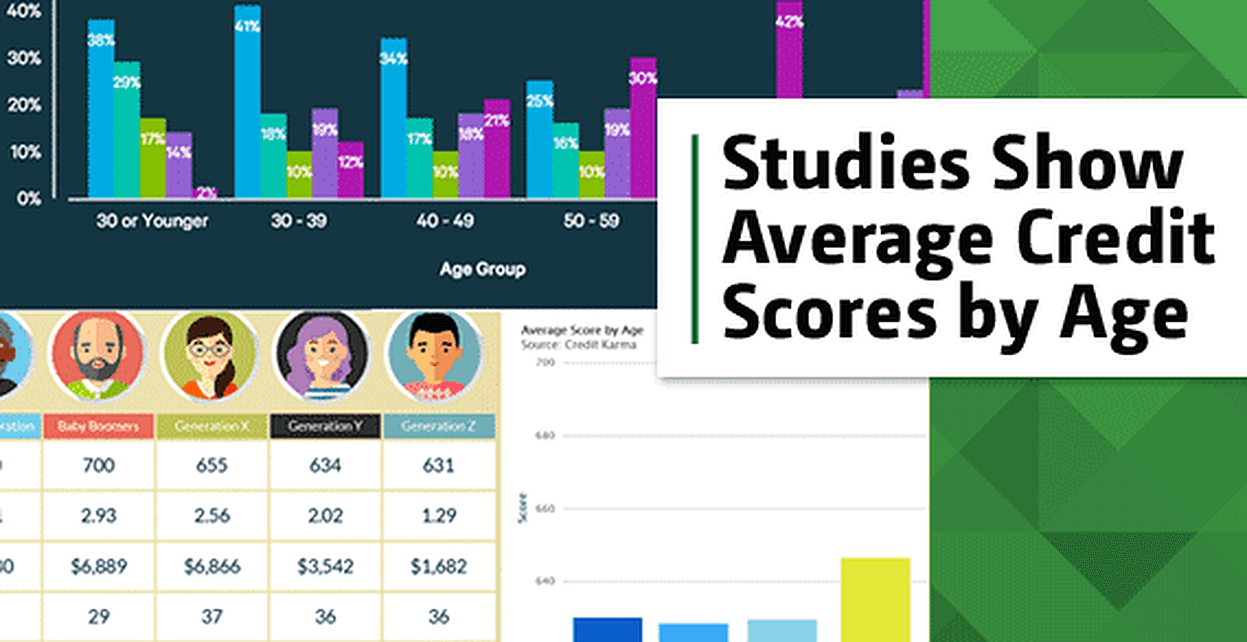

Worse, credit rankings and scores do not appear to be equally distributed across the many different peoples who call the United States of America home. In 2019, Experian (one of the three companies who track and decide individual credit scores) declared that about 16% of the total U.S. population has “poor credit” (usually listed at or below 579). This statistic is somewhat worrisome, showing that nearly one out of every five Americans is struggling with their credit score, but Experian is quick to counter that the average credit score in the U.S. has been steadily increasing the last few years despite the pandemic. Which is comforting news, just not so much for Black or Brown Americans who statistically bear the brunt of lower credit scores. A 2021 survey of 5,000 U.S. adults by the financial management company Credit Sesame found that only 37% of White Americans fell below the poor credit line, while Hispanic Americans came in at 41% and Black Americans at a whopping 54%.

It would seem that while credit scores are increasing on average for Americans, they are not increasing for all Americans. While the reasons for this discrepancy are many and varied, the bottom line is that many Black and Brown Americans are caught in a vicious loop of poor credit leading to worse financing options, leading to more poor credit, leading to worse options, and on and on…

Such systemic injustices, even if not explicitly racist, are deeply ingrained into our modern financial institutions and consistently lead to cruel and racist results. Such injustices can only be solved by collective recognition of the issues and comprehensive reform of our financial institutions. It is not advisable that our Black and Brown readers hold their breath while they wait for that to happen. So what can people with low credit do about their situation in the meantime? Fortunately, our economic systems are adaptable if imperfect, and some options still remain for those who have bad or no credit scores.

When it comes to financing a vehicle, one option that still remains to those without a good credit score is the “buy here, pay here” method. These offers allow potential buyers to skip the bank or loan specialist and negotiate financing a loan directly with the dealer. This option can be very appealing to those who cannot hope to secure a loan from other places because of their credit, and is often advertised as such. These deals vary from dealer to dealer however, with some being fair enough to the buyer to be a kind of win-win for both parties, and some at the other end of the spectrum being downright predatory with towering interest rates. Nearly every one of such deals is unique to the dealer and situation at hand, so researching specific offers with due diligence is a must. With the proper scrutiny, it is possible to find fair arrangements from dealers simply wishing to tap into the low credit market without exploiting it.

In trying to find the right offer for you, it may be worthwhile to research dealerships who specialize in serving the poor to-no-credit market. In trying to appeal to this niche of the auto buyer market, these dealerships are more likely to make fair offers than their counterparts just looking to score a quick sale by pulling one over on you.

One such dealer in the local area is Car Credit Tampa. Founded by the son of an immigrant family, Car Credit takes a focus on new immigrants to the country who have likely had no opportunity to build their credit before coming here. As such, a key piece of their business model is to routinely offer fair “buy here, pay here” plans to those who would have no ability to finance a vehicle otherwise. Options like these can be a lifeline to struggling families searching for somewhere to turn for their needs.

Based on the evidence, there can be no doubt that our credit score based financial system has glaring flaws which need to be addressed. Today, beyond hoping that collective recognition of these flaws and pressure on our representatives to reform them will result in fairer systems in the future, the only recourse for those suffering from poor credit or lack of any credit entirely is to work harder, research more diligently, and find more creative ways to finance their necessities than their luckier compatriots. In the meantime, non-predatory “Buy here, pay here” plans like those offered by Car Credit Tampa can be a band aid over this societal wound. They won’t fix the unfairness forced on poor-or-no credit Americans today, but they can at least give them an option to make their lives a little easier while they await the justice of tomorrow.

Original Author:

Garrison Rose

References Cited (In order of appearance):